Positioning Your Clients for 2026: Self-Funded Strategies for Brokers

As you prepare for another year of healthcare complexity and rising costs, one truth is clear: you cannot navigate this industry in a silo.

Client Expectations of a Partner

Employers expect you to bring forward partners – TPAs, PBMs, clinical vendors, stoploss, wellness solutions – that align to create an affordable, accessible, and personalized benefit to their members.

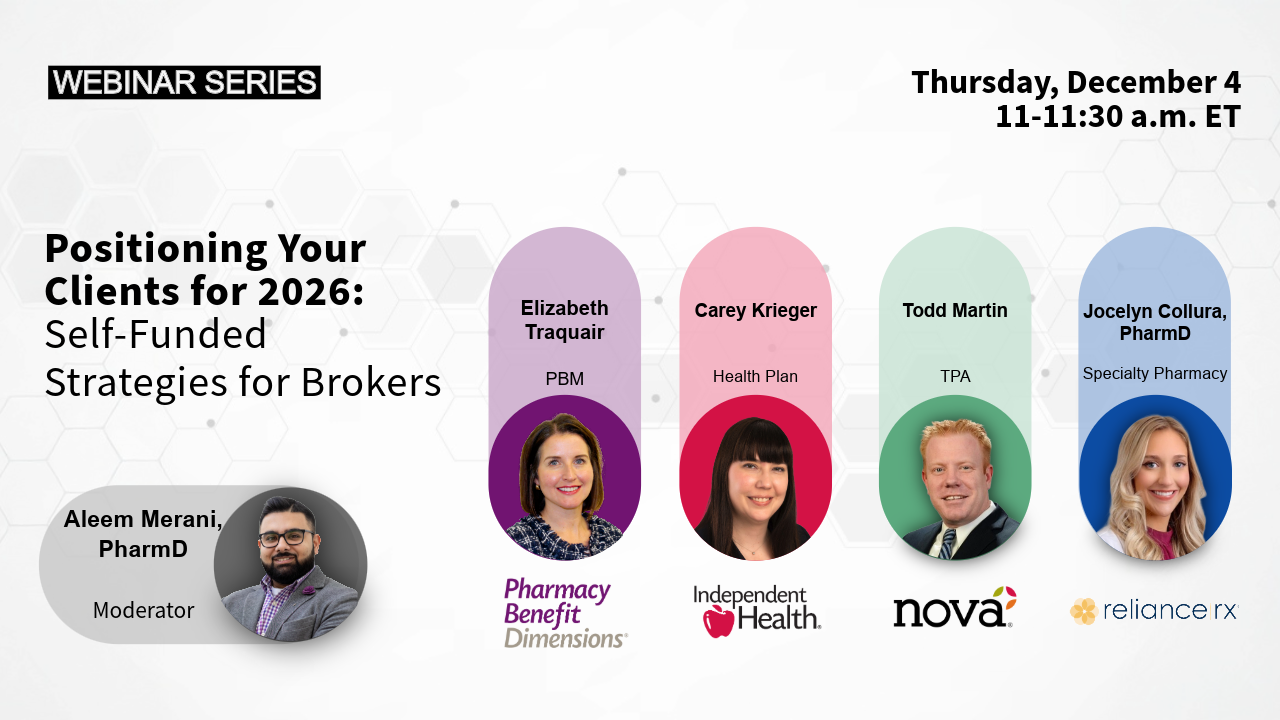

During our year-end webinar, “Positioning Your Clients for 2026: Self-Funded Strategies for Brokers,” PBDRx and a panel of healthcare experts highlighted opportunities brokers and consultants should leverage to protect budgets, elevate the member experience, and strengthen renewals in the year ahead.

Below is a recap of impactful, broker-focused insights including strategic questions you should be asking and actions you should be taking before renewals hit.

1. Leverage Self-Funding to Increase Control

Self-funded plans have risen in popularity as employers look for more control and customization in their healthcare strategy. Over two thirds of U.S. workers are covered by a self-funded health insurance plan, exhibiting a steady climb over the last two decades. Employer cost drivers include:

- Rising healthcare premiums that have outpaced inflation.

- Tighter company budgets and evolving workforce needs.

Technology Benefit: Telehealth

Self-funded plans are increasingly seeking innovative coverage options through virtual care to improve access, convenience, and cost efficiency. Employers who adopt integrated telemedicine services see ~43% savings to the health plan per visit. These services come with improved engagement and outcomes among members.

Broker Takeaways

- Identify clients who would benefit most from telehealth integration.

- If a telehealth program is presently offered, evaluate utilization as many brokers discover members aren’t using what’s already available.

- Quantify additional savings and develop member education strategies to improve benefit design and encourage members’ use.

Questions Brokers Should Ask

- Which clients will gain the most from virtual care steering based on claims?

- Is telehealth being communicated to the client and being utilized effectively?

2. Deliver Increased Predictability and Transparency with Level-Funded Plans

As costs rise and expanded solutions emerge, more small-to-medium sized employers are turning to level-funded models for:

- Budget stability

- Fully transparent claims data

- Customizable benefit design

Heading into 2026, adoption continues to accelerate because these plans offer predictability and control across a wide range of cost pressure, such as increased GLP-1 use and specialty medication pipeline volatility. The use of AI when evaluating eligibility and quoting will provide more opportunities for forecasting and lookback.

Broker Takeaways

- Review your book of business and identify clients who should evaluate level-funding as described above.

- Consider using AI to identify opportunities and risk when met with incomplete data.

Question Brokers Should Ask

- Which fully insured groups could benefit from a more predictable level-funded model?

3. Take Control of Specialty Costs with Strategic Clinical Integration

Specialty medications continue to dominate drug spend, despite less than 5% of the population requiring treatment with these drugs. Without proactive management, specialty costs will continue to impact renewals and new opportunities.

Partners with strong specialty programs, proactive care management, and site-of-care optimization can reduce costs by up to 60% while significantly improving adherence and outcomes.

Upcoming 2026 biosimilar and generic launches for Xolair, Simponi, Perjeta, and Orencia* will create major savings opportunities for self-funded employers who are willing to adopt smart clinical programs.

It’s also important to note that significant reimbursement differences persist between outpatient hospitals and alternative sites of care. There is a potential savings of 30-60% for employers who work with a specialty pharmacy to take advantage of Site-of-Care (SOC) management opportunities.

Broker Takeaways

- Request a specialty disruption forecast for your top 510 cost drivers.

- Evaluate your PBM partner’s hands-on approach to managing biosimilar conversion.

- Review site-of-care data for medications billed under the wrong benefit and work with your client to educate members about resources available in their area.

Questions Brokers Should Ask

- Am I confident that my partners can guide cost-effective utilization as biosimilars launch?

- What specialty categories are trending upward in my book – and do I know why?

4. Prepare Clients for 2026 Medicare Changes and IRA-Driven Drug Changes

The Inflation Reduction Act and the Medicare Drug Price Negotiation Program will reshape pricing for these 10 drugs:

- Eliquis

- Jardiance

- Xarelto

- Januvia

- Farxiga

- Entresto

- Enbrel

- Imbruvica

- Stelara

- Insulin-aspart products (Fiasp, Novlog, etc.)

These changes will influence benefit design, cost, and member experience. Brokers who help clients anticipate these changes – not just react to them – will be in the best position to guide strategy in a shifting regulatory landscape.

Broker Takeaways

- Educate clients early on IRA changes and shifting price dynamics.

- Coordinate with PBM to get a sense of change of plan and risk.

Questions Brokers Should Ask

- How exposed are my clients to drugs affected by IRA price negotiation?

- Do I have a communication plan to inform employers of changes?

Turn Insight into Strategy for 2026

Healthcare is becoming more complex, more regulated, and more costly, but also more integrated. With a focus on managing risk and cost, clients increasingly seek to work with consultants and brokers who understand their needs and make data-informed decisions in alignment with the right healthcare partners,

At PBDRx, we and our partners are here to help brokers turn strategic insights into actionable, client-focused solutions.

Want to dive deeper into how these trends apply to your book of business? Let’s schedule a new year strategy session to start the new year with clarity, control, and confidence.

*Note, not all listed medications will be added to plan formularies.